A home appraisal is required if you are financing the property.

Once you’ve completed your inspection and negotiated repairs, your lender will want to order your appraisal. The lender will request that you pay for your appraisal in advance. The typical cost will range somewhere between $500-550. This fee is part of the closing costs disclosed on the loan estimate. It’s paid in advance and you later get credited on your Closing Disclosures.

An appraisal can make or break a home sale. It can move you to the next step in the home buying process or take you back to the negotiation table.

What is an appraisal?

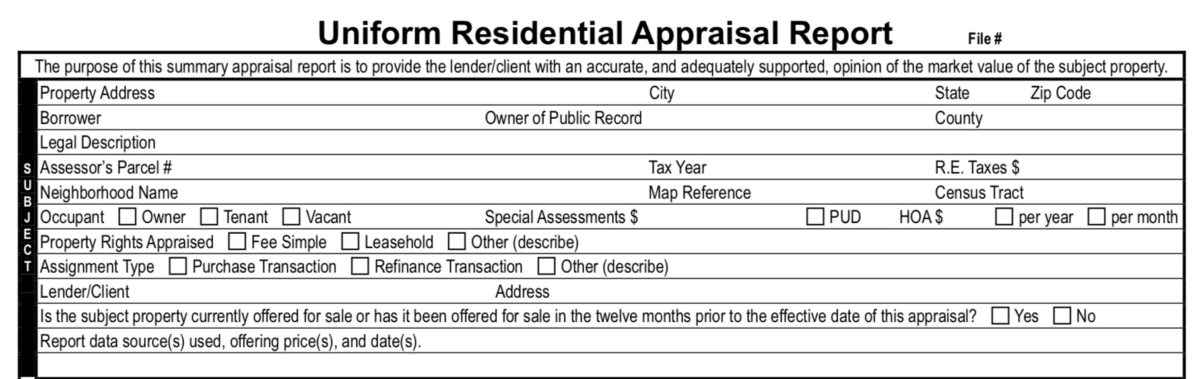

An appraisal is the estimated value of a home determined by an inspection of the property and comparison of recently sold homes in the area to estimate the value.

The findings from an appraisal determine the amount a mortgage lender will let you borrow for the property. In a purchase transaction, it protects the buyer from paying more than the house is worth.

An appraiser uses similar homes that have recently sold in the area to determine value. These homes are known as comparables, or “comps.” The appraisal is completed by a third-party appraiser who has no connection to the buyer, seller or lender.

Inspections Vs. Appraisals

A home appraisal is required by the lender. An inspection is optional (although highly recommended). The lender does not require an inspection. An inspection is completed for the benefit of the buyer. The buyer will hire and pay for the inspection. The lender will schedule your appraisal for you but require that you pay the corresponding fee in advance. The appraisal fee is an upfront fee that is not refunded if either party fails to move forward with the sale.

An appraisal determines the home’s value, while an inspection determines its condition.

Types of loans and requirements

Depending on the type of loan you get, the appraiser will inspect certain parts of the home for specific reasons. They’ll inspect the home to ensure that the home has things such as heat and electrical that are working properly. They will check for safety issues. FHA loans, VA loans, and USDA loans will have more specific requirements. If the appraiser finds something that must be repaired, they will list the item as a “lender required repair” that has to be completed before you close on the home.

The following are a few examples of deal breakers if not repaired prior to closing:

- Exposed floorboards and wall studs to be secured

- Chipped or peeling paint, especially lead-based paint if built before 1979, must be scraped and painted

- Water damage must be addressed

- Holes in the roof or siding must be repaired

- Major driveway or sidewalk damage must be corrected

- Clean drinking water, a water heater, and a sewage system

- Working electricity, heating and air conditioning

- Roofing should be functioning properly and should have at least 3-5 years of life left

- Major foundation problems

- Active pest and termite

What does the appraiser look for? What can affect the value?

The appraiser’s job is to assign a fair market value. The condition of the property can affect the value of the home and can impact the lender’s decision to lend you the funds for the home.

- Health and safety issues can be a deal breaker. These will typically be listed as lender required repairs.

- Working HVAC system

- Any lead or peeling paint, but only if the house was built prior to 1979

- Quality of the electrical and plumbing

- Evidence of termites or pests

- Structural integrity of the home can also cause a lender to deny funds if they are not repaired prior to closing. This can include:

- Condition of the roof and foundation

- Condition of the chimney

- Condition and type of driveway surface

- Some upgrades or improvements can increase value. This is a very complicated area. The value will vary based on the surrounding comparables and how you fit into the community.

Personal property is not taken into account when establishing the property’s value.

Appraisal Results

- Home appraises for more than the agreed upon sales price = Yay! This benefits the buyer and basically means that you are going into the home buying process with equity. The lender will move forward with the loan as expected.

- Home appraised for sales price = the loan will be processed as usual.

- Home is appraised lower than the agreed-upon purchase price:

- Option 1 – Seller will adjust the price to the appraised value.

- Option 2 – The buyer will pay at closing the difference between the agreed upon sales price and the appraised value.

- Option 3 – The buyer and seller will compromise. The seller will adjust a certain amount and the buyer will pay a portion at closing.

- Option 4 – Both buyer and seller cannot reach an agreement and the agreement is canceled.

A home appraisal report is property of the buyer and isn’t shared with the seller unless we do not meet value. If the appraisal comes in low, then we will typically share the report to prove that the value came in low.

How long are the appraisals valid?

A home appraisal is good for a total of 120 days (4 months).

How long will it take to get the report back?

You should receive a copy of the report within 5-7 days after the appraisal was completed.