Please note that what you have received from your lender was a pre-qualification. The loan approval comes later, after they review everything. You will typically get the “clear to close” a week prior to your closing, and you will get your “closing disclosures” 3 days before closing.

If you decide to switch lender or the type of financing, we will need an updated lender pre-approval as soon as possible. Please talk to me first so we can review timing.

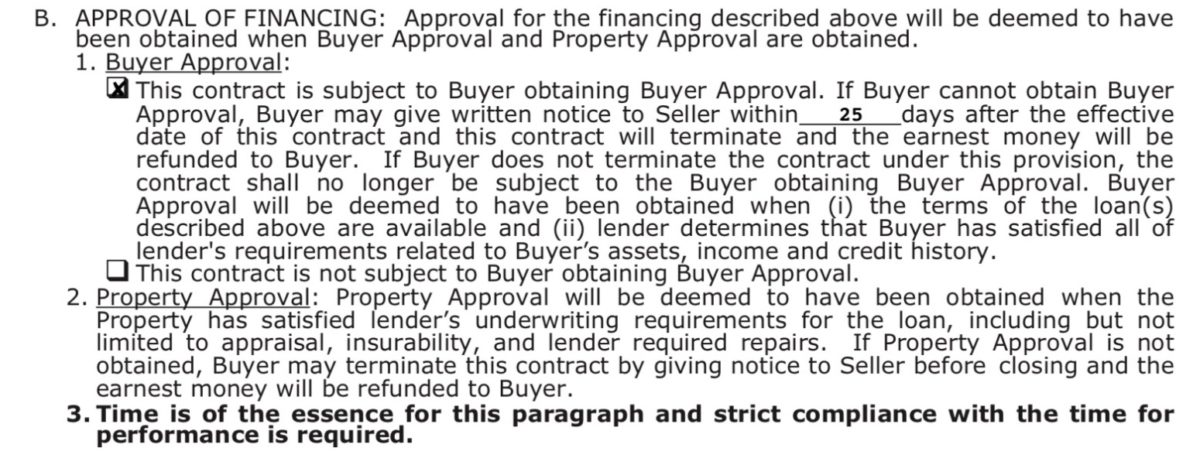

LOAN COMMITMENT

You have a set number of days (page two of the third party finance addendum) after acceptance to obtain a loan commitment (which is the lender’s agreement to make money available to a borrower in a specified amount, at a specified rate, and within a specified time) from your lender of choice. In order for the lender to give you a loan commitment, you need to apply for the loan, provide the necessary documentation that the lender requires of you, make decisions regarding your type of loan/rate and the lender will order an appraisal. Once the lender receives the appraisal and all appropriate paperwork, they will underwrite the loan and then issue a loan commitment.