Are you financially ready to buy a home? Your cash

There are several expenses incurred when buying a home. These are expenses that must be paid before, at closing and after. It’s important that you have these funds ready and available once you start the process.

Some of these funds may be gifted but check with your lender. Some lender will ask for a letter stating that the funds are a gift and not a loan.

Before you glance at the numbers below and disqualify yourself, please note that there are down payment assistance programs available that can help with a large portion of these funds. Ask me more about these programs.

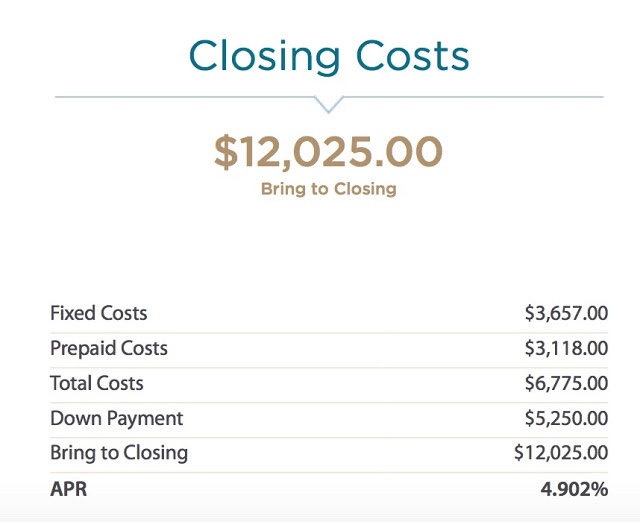

Below you will find the closing costs for a home purchased for $150,000.00 and using an FHA loan.* This is just an estimate. Exact figures will vary based on your closing date, lender and title company.

- Home Price – $150,000

- Down Payment – $5,250

- Interest Rate – 3.750%

- PITI (principal, interest, taxes and insurance) – $1,238

Prepaid costs: Prepaid items are always required at loan closing, whereas escrow accounts are only required in certain cases. Even if you close your loan right before the month’s end, you owe your lender at least a few day’s worth of mortgage interest. This is because your first mortgage payment isn’t due immediately after you close. It is generally due on the first day of the second month following your close. You owe prepaid interest through the end of the month in which you close. Additionally, you generally have to prepay the first year’s premium for hazard insurance and mortgage insurance if your lender requires it.

Escrow: Escrow accounts are generally required by the lender if you put less than 20 percent down on your home, or refinance with less than 20 percent equity. An escrow account ensures the lender that property taxes, mortgage insurance and homeowners insurance will be paid. Requirements for escrow reserves serve as a cushion and vary by lender, according to the Department of Housing and Urban Development. The amount a lender collects also depends on when the closing takes place. Most lender will make the equivalent of 3 months of taxes and insurance

Earnest Money Deposits: This is a cash deposit attached to you purchase offer. The amounts of this deposit varies but expect to pay at least 1% if you are financing the balance and maybe as high as 10% if you are paying cash. Although earnest funds are not required they are expected. If your offer is accepted and you proceed with the purchase, this deposit is applied towards the purchase of your property.

Home Inspections: Every buyer should have their home inspected. This is usually done within 10 days of the executed contract. The cost will vary based on the inspection completed. The most common inspections are a general inspection that may run approximately $450 and pest inspections that may cost approximately $150.

In some cases you might have to inspect the foundation, a water well, a septic tank, etc. and these all have a separate cost.

Option Fee: This is a fee that is paid to the seller for the ability to have your inspection period. This fee will allow you to inspect the home within a given amount of time and back out of the agreement if you do not like the results. The fee varies but typically runs $100-300 for a 10-day period. Money well spent if it allows you to back out of the contract as a result of a bad inspection.

These funds can be created to the purchase of your home if you proceed with the contract; if you decide to back out, your forfeit the funds.

Appraisal: If you are financing your home purchase, the bank will want to appraise your home. The purpose of an appraisal is to make sure the home you are purchasing is worth the amount you agreed to pay. The bank will not want to finance 100K for a home that is valued at 80K.

Appraisals typically cost approximately $400. Sometimes this balance is paid in advance and sometimes it is added to the closing costs and paid upon closing.

Down payment: For most people the minimum down payment will be 3.5%. This only applies to FHA loans. There are some exceptions for low income down payment assistance programs and VA loans require no down payment.

For a conventional loan a minimum of 5% is acceptable for borrowers with excellent credit but that said, anything under 20% will require the borrower to pay private mortgage insurance. This additional, lender’s insurance policy will just add to your overall monthly payment. It’s always best to pay at least 20%.

Mortgage origination fee and title insurance: Loan origination fees will vary from lender to lender but typically it can run from 1-3%. This is typically paid at closing. The owner’s title insurance is a negotiable expense and may be paid by the seller. Your real estate agent can help you with that negotiation. The cost will vary based on the cost of the property.

It’s important to review the good faith estimates that your lender provides. The good faith estimate is an estimate of your closing costs.

Other possible closing cost: Loan policy and endorsements, record warranty deed, record deed of trust, courier fee, escrow fee, tax service fee, one year homeowner’s insurance policy, 2-3 month hazard insurance escrow, tax reserve, credit report, lender document preparation, flood certification, mortgage insurance premiums, misc. loan fees, survey, homeowners’ association dues, guaranty fee. It will be important to review the good faith estimate for these fees.

Moving Costs: Moving costs will depend on how far you will be moving. If you do it yourself and you are moving locally it may cost you approximately $1000 for truck rentals, gas, moving supplies etc. If you hire movers and again move locally, it may cost $2,500-$6,000 for the average 2000-3000sf home. Long distance moves will cost much more.

Don’t ignore this expense. Price out the move before closing so you can be prepared for the cost.

Other Home Purchases: If you are moving from an apartment to a single family home, you will need to buy a few items after closing: lawn mower, weed eater, window treatments, furniture, etc. Normal maintenance items such as air conditioning filters, light bulbs, season lawn items etc.

Once you are a homeowner you will find that there are countless things that you can do to your home and most of them will involve cash. Some of these items can be improvements and some can be needed maintenance. Make sure to always have cash reserves to cover these maintenance. Maintaining your home, is maintaining your investment.

If you have any questions or if you would like assistance in buying, selling or renting give me a call. I’m happy to help.