Spring Home Maintenance Checklist

Spring is the perfect time to refresh your home after winter. This detailed checklist covers indoor and outdoor tasks to keep your home in top shape.

📌 Exterior Maintenance

1. Roof & Gutters

[ ] Inspect the roof for missing, loose, or damaged shingles. Use binoculars to take a closer look.

[ ] Clean gutters & downspouts to prevent clogs and water damage. Check for damage and make repairs.

[ ] Check for leaks around flashing, chimneys, and vents. Check soffits. Soffit vents should be clear and clean so your home can breath.

[ ] Ensure proper drainage, extend downspouts at least 5 ft from the foundation. Check for gutter leaks and rust

[ ] Trim all plants/trees that are touching your home.

Tip: Install gutter guards

2. Siding & Paint

[ ] Wash exterior walls to remove dirt, mildew, and pollen.

[ ] Inspect for peeling paint or rot, repair as needed.

[ ] Check caulking around windows and doors for gaps.

3. Windows & Doors

[ ] Clean windows & screens (inside and out). Fix torn screens

[ ] Check weatherstripping and replace if worn.

[ ] Lubricate door hinges & locks with silicone spray.

Tip: Have a fear of spiders? Just spray some WD-40 on places where spiders and other insects can get in, such as window sills and door frames. It will keep the spiders and other bugs out.

Tip: Sticky windows?

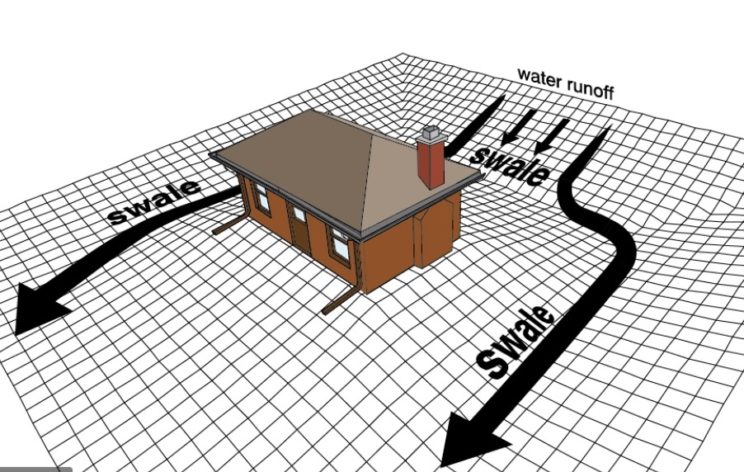

4. Foundation & Drainage

[ ] Inspect the foundation for cracks or water damage.

[ ] Grade soil away from the house (slope should be 6 inches over 10 ft).

[ ] Clear debris from drainage systems (French drains, etc.).

[ ] Repair cracked concrete

5. Deck & Patio

[ ] Sweep & wash deck/patio surfaces.

[ ] Check for loose boards or nails, tighten or replace.

[ ] Apply sealant or stain if needed.

[ ] Inspect outdoor furniture, clean or repair as necessary.

6. Yard & Landscaping

[ ] Rake leftover leaves & debris to prevent mold.

[ ] Aerate & fertilize the lawn for healthy growth.

[ ] Prune shrubs & trees (trim branches away from the house).

[ ] Check sprinkler system for leaks and adjust spray heads. They should be spraying away from your home.

[ ] Mulch garden beds to retain moisture and prevent weeds.

[ ] Look for insect infestation. Carpenter Ants, Termites swarm in the spring. If there’s a bunch of winged insects flying out of a hole in the woodwork, it might be termites.

7. Outdoor Plumbing & HVAC

[ ] Turn on outdoor water supply and check for leaks.

[ ] Inspect hoses & faucets for winter damage.

[ ] Service AC unit: Clean condenser coils, change filters, and check refrigerant levels.

🏠 Interior Maintenance

1. Deep Cleaning

[ ] Dust ceiling fans & light fixtures.

[ ] Blean blinds and window treatments

[ ] Organize closets & storage areas (spring decluttering!).

[ ] Clean your Garbage Disposal

[ ] Clean your dishwasher

[ ] Clean your washing machine

[ ] Overall Maintenance & Clean Refrigerator Coils

[ ] Clean the range hood filter

[ ] Clean your dryer vent (super important, it’s one of the most common cause of fires)

Tip: Other items to clean and maintain in the kitchen

2. HVAC System

[ ] Replace air filters (do this every 1-3 months).

[ ] Schedule professional HVAC maintenance (Ideally schedule maintenance twice a year, spring and fall).

[ ] Clean vents & ducts to improve air quality.

3. Plumbing Check

[ ] Inspect under sinks for leaks.

[ ] Test sump pump (pour water into the pit to ensure it activates). (if applicable)

[ ] Flush water heater to remove sediment buildup.

[ ] Check for loose faucets and shower heads.

[ ] Check the caulking around toilets, bathtubs, faucets, showerheads, sinks, etc.

[ ] Remove hard water stains using Bar Keepers Friend and WD40. Especially on glass.

[ ] Running toilet?

Tip: Do you faucets or shower heads have low pressure or starts spraying to the side, it’s usually due to a dirty aerator screen. To remove the mineral and other deposits, soak the aerator in vinegar, then scrub it with a toothbrush. This usually solves the problem. Still having issues? Do a showerhead deep clean.

Tip: How to unclog a drain

Tip: things you should not put down the garbage disposal

4. Safety Checks

[ ] Test smoke & carbon monoxide detectors (replace batteries if needed).

[ ] Check fire extinguishers (ensure they’re charged and accessible).

[ ] Review emergency exits & plans.

5. Attic & Basement

[ ] Look for signs of pests (rodents, insects).

[ ] Check for moisture or mold, improve ventilation if needed.

[ ] Insulate pipes to prevent condensation.

🚗 Bonus: Garage

[ ] Declutter & organize the garage

[ ] Inspect garage door, lubricate springs and tracks.

✅ Final Step: Schedule Repairs

Make a list of any major issues (roof leaks, foundation cracks, etc.) and schedule professional help if needed.

24 DIY Tools You Should Have at the Ready for Quick-Fix Home Repairs

By tackling these tasks, your home will be ready for summer! 🌸✨