Now a days home sellers have several options available to sell their home. They all have pros and cons. I think it’s important as a seller to do your research and see what’s right for you. All these options fill a need for some seller.

Please note that this is a very general overview of your selling options; it’s not all inclusive. I’m covering the most common options that come up when chatting with clients. This is just a starting point. Please do further research on any options suits you.

As a REALTOR® we can not give you advice on these services. Nor can we guide you through these other selling options. This page was created for educational purposes only.Commission DistributionCommission Distribution

Let’s explore some of these options.

Traditional Brokerage Firm

- Traditional Real Estate Brokerages

- This is normally a full service brokerage. A set percentage is negotiated. The agent starts the sales process. What does the agent do for you?

- Please note that every brokerage firm has their established fees. There is no set fee for all brokerage firms. The fee is split between the listing brokerage and the selling brokerage.

- Real Estate TV shows are not reality. They have certainly implied that REALTOR® make thousand with very little work, one party or one sale. The realty is that the agent does not take home the percentage negotiated. What does a REALTOR® actually makes? Commission Distribution

PROS

- Real Estate agent will facilitate the sale or purchase of a contract. Your agent know how and when things are done.

- Agent can spot potential problems. Being proactive is always cheaper than reactive.

- A real estate agent acts like a mediator between the buyer and the seller.

- Home is promoted on the master listing system (HAR.com) and distributed to other sites such as Zillow, Trulia, Home.com, etc.

- Agents know what buyers want. It’s important to make your home as marketable as possible. This will translate into more income for a seller.

- Only buyers that are qualified and represented will access your home.

- CONS

- Cost, especially is you don’t have equity in the property.

- Selling a home takes time. If you have to move fast this can become an issue.

- Risk of not knowing the paperwork or the process.

- It’s time consuming to market your property properly and legally.

For Sale by Owner (FSBO)

- For Sale by Owner (FSBO)

- A seller will put their home on the market themselves. They may or may not list it online. They will place a sign on their yard and show their own property. They will negotiate their sale and handle the contract themselves or hire a lawyer to write up the contract. The seller will handle the sale from start to finish.

- PROS:

- Potential savings in commission payments

- Seller will have total control over the entire process.

- CONS:

- No access to reliable comps so establishing a sales price might be difficult. You will be a target for bargain shoppers.

- Limited online marketing because you can not list your property in the city’s Master Listing Service (HAR.com). FSBO websites are not as effective.

- Seller will have to schedule and manage all showings. There can be safety issues.

- Seller will have to make sure the buyer is qualified and they will have to negotiate during all stages of the sales process.

- Lack of legal forms. Seller will have to take care of all the paperwork and make sure he discloses all the required disclosures.

- PROS:

- A seller will put their home on the market themselves. They may or may not list it online. They will place a sign on their yard and show their own property. They will negotiate their sale and handle the contract themselves or hire a lawyer to write up the contract. The seller will handle the sale from start to finish.

We Buy Homes for Cash

- We buy homes for cash

- You see these signs every where. These are investors that buy homes with cash or hard money loans. Overall a home owner can expect about 60-70% of the market value or less if the home is in bad shape. This may be a good option for certain home owners.

- PROS:

- Fast closings

- Cash sales so there are no finance contingencies

- Properties in poor condition are typically accepted as-is

- CONS:

- Lower sales price

- The offers usually have very little wiggle room because the investors follow a formula. They too have to make money after repairs and upgrades.

- Home owners have to make sure the buyers are legit and they have the funds to close the deal.

- These companies typically will use their own contract. The home owner should have them reviewed before signing the agreement.

- PROS:

- You see these signs every where. These are investors that buy homes with cash or hard money loans. Overall a home owner can expect about 60-70% of the market value or less if the home is in bad shape. This may be a good option for certain home owners.

Real Estate Wholesalers

- Wholesaler

- These are the home finders that tie up homes under contract for a finder’s fee. They will look for distressed homes, negotiate with the home owner, come up with a rehab plan, then find an investor that would want to take it on. If they find an investor they will assign the contract to the investor for a “finders” fee. Typically the offer received will have the buyer listed as: ABC buyer and assigns. This will allow the buyer to assign the contract to the ultimate buyer. These buyer will also typically request a long option period so they can get bids for the work to be done.

- PROS:

- Usually cash deals so if they go through, normally they can close soon in less than 30 days.

- You can sell the property as-is.

- CONS:

- The homeowner’s home is tied up in a contract that has a higher possibility of falling through.

- Lower sales price. The wholesaler (finder) and the investor has to make a profit so the sales price will alway be low enough to cover these profit margins.

- The wholesaler will want to have their team of contractors to tour the property in order to give him their rehab proposal.

- The wholesaler might want to have potential investors tour the property.

- Many times the home owner doesn’t even know who is buying their home.

- Wholesalers will normally use their own contracts and they are written in the wholesaler’s favor. They will typically give the wholesaler an out if he can’t find an investor.

- PROS:

- These are the home finders that tie up homes under contract for a finder’s fee. They will look for distressed homes, negotiate with the home owner, come up with a rehab plan, then find an investor that would want to take it on. If they find an investor they will assign the contract to the investor for a “finders” fee. Typically the offer received will have the buyer listed as: ABC buyer and assigns. This will allow the buyer to assign the contract to the ultimate buyer. These buyer will also typically request a long option period so they can get bids for the work to be done.

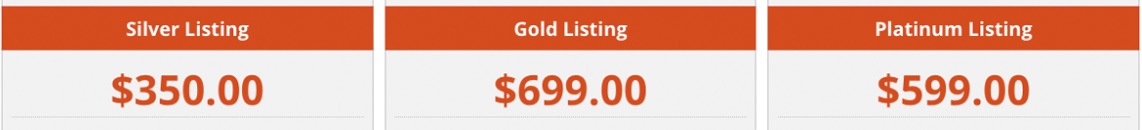

Flat Fee or Discount Brokerage

- Flat fee and discount brokerage

- These brokerage firm will offer a flat fee for specific services or a lower commission rate on the listing side only. These are a la carte services because everything outside of the list of services offered (for this specific fee) is at an additional cost. These can add up quickly.

- PROS:

- Potential savings in selling fees

- You decide what services you’d like to use

- CONS:

- Limited services for the discount fee and everything else is at a cost

- Deceiving advertising. Read the small print. There are many loophole in the rebates or discounts they offer.

- Make sure that they aren’t only listing the property. That means that you might be requested to do everything else.

- Find out where the property will be listed. It should be listed on the master listing service (HAR.com)

- PROS:

- These brokerage firm will offer a flat fee for specific services or a lower commission rate on the listing side only. These are a la carte services because everything outside of the list of services offered (for this specific fee) is at an additional cost. These can add up quickly.

IBuyer Companies

- IBuyers – An iBuyer is a company that uses technology to make an offer on your home instantly. The most recognized IBuyers are OpenDoor, Offerpad and Zillow. Each IBuyer works a little differently but for the most part the company will estimates the value of your home and makes an offer and disclose their fee. If you accept, documents will be signed and a home assessment is programmed. Once the IBuyer’s has assessed your home they will most likely ask you to make repairs or they will modify their offer to represent the repairs that need to be done. Once repairs are resolved, the seller will decide when to close, usually 10-60 days after.

- PROS:

- Your home is never on the market and buyers will not have access to the property while you live in it.

- You choose the closing date after you’ve reached an agreement with the IBuyer.

- CONS:

- The home is never on the open market so you really don’t know how much you would have recieved. How do you know it’s fair market value?

- Your home is still going to be inspected and further negotiations will be completed after the initial offer.

- PROS: