COMING SOON!

- 2 bedroom

- 1 bath

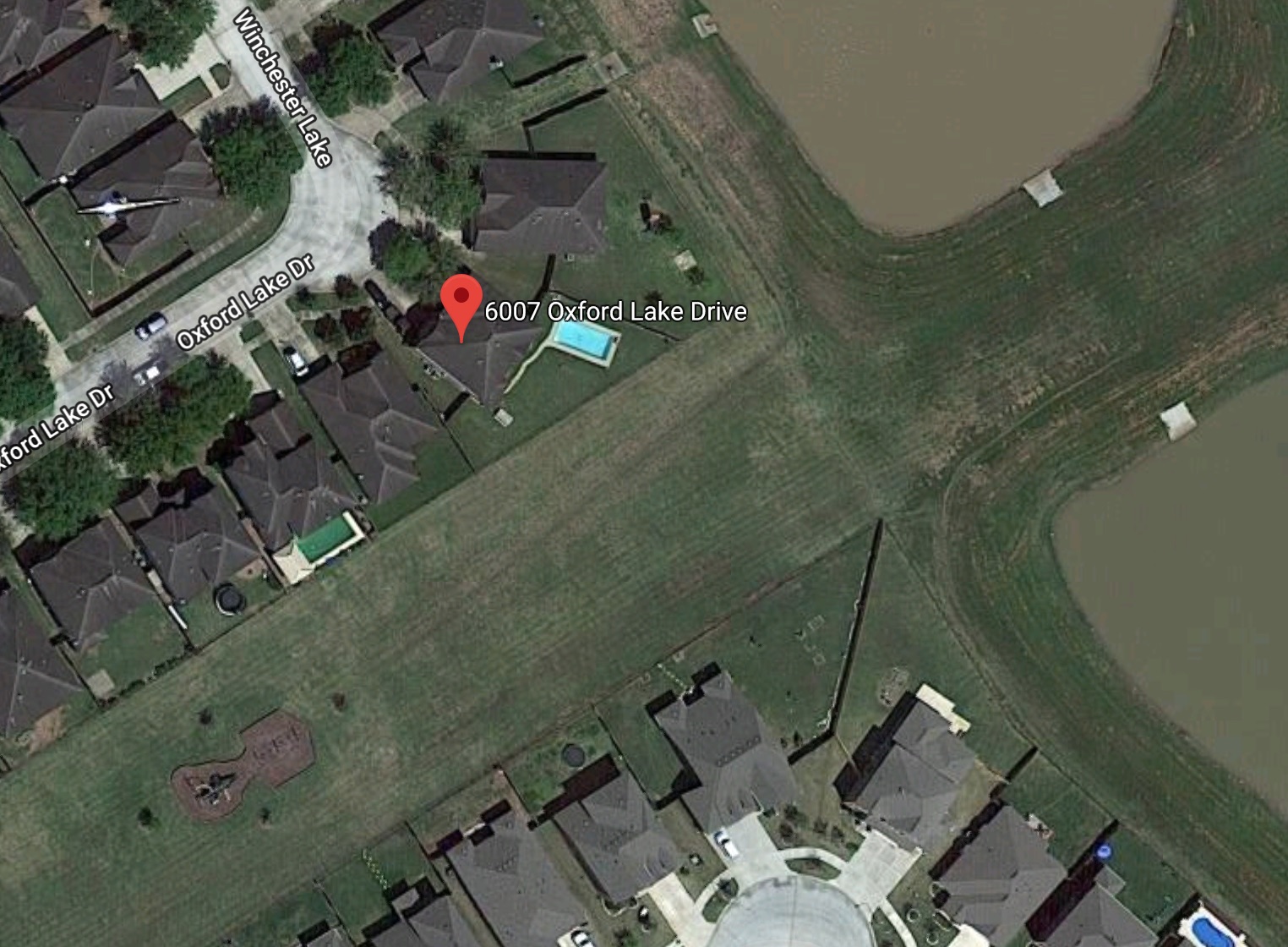

- Building 942 SF

- Lot 5,000 SF

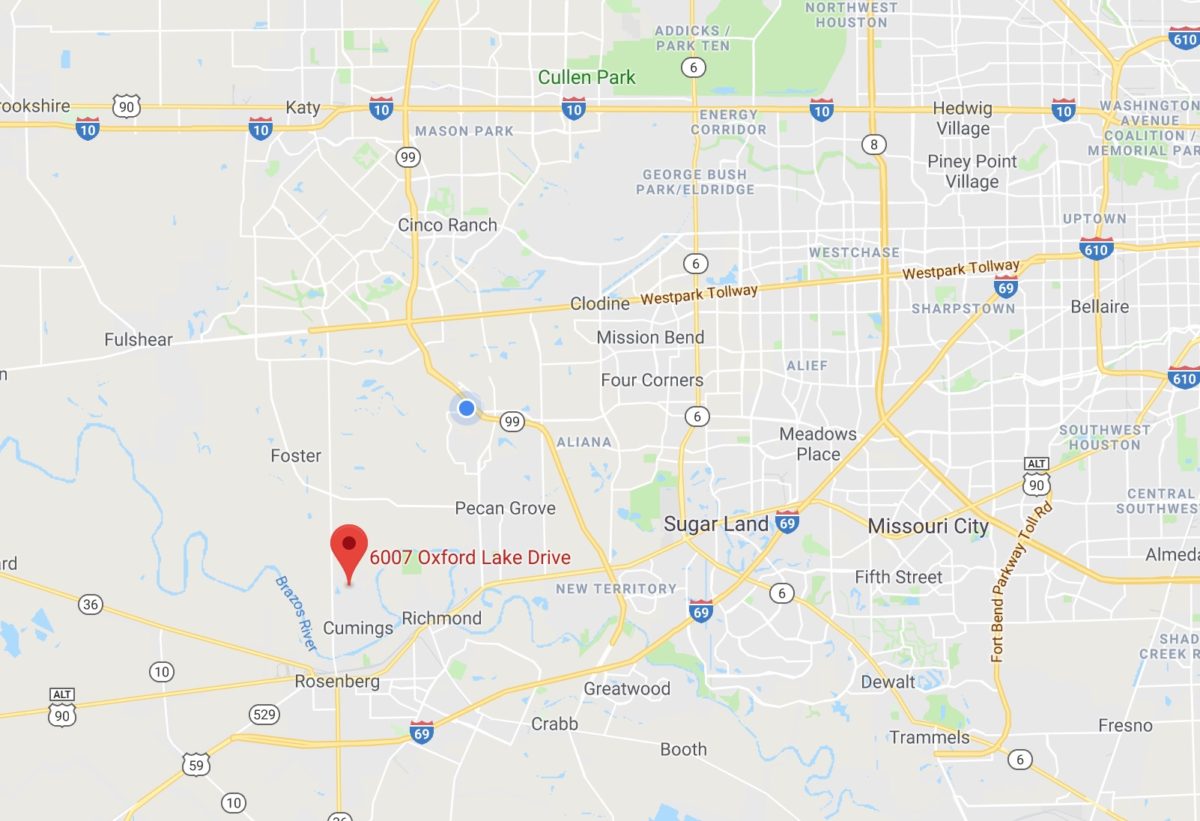

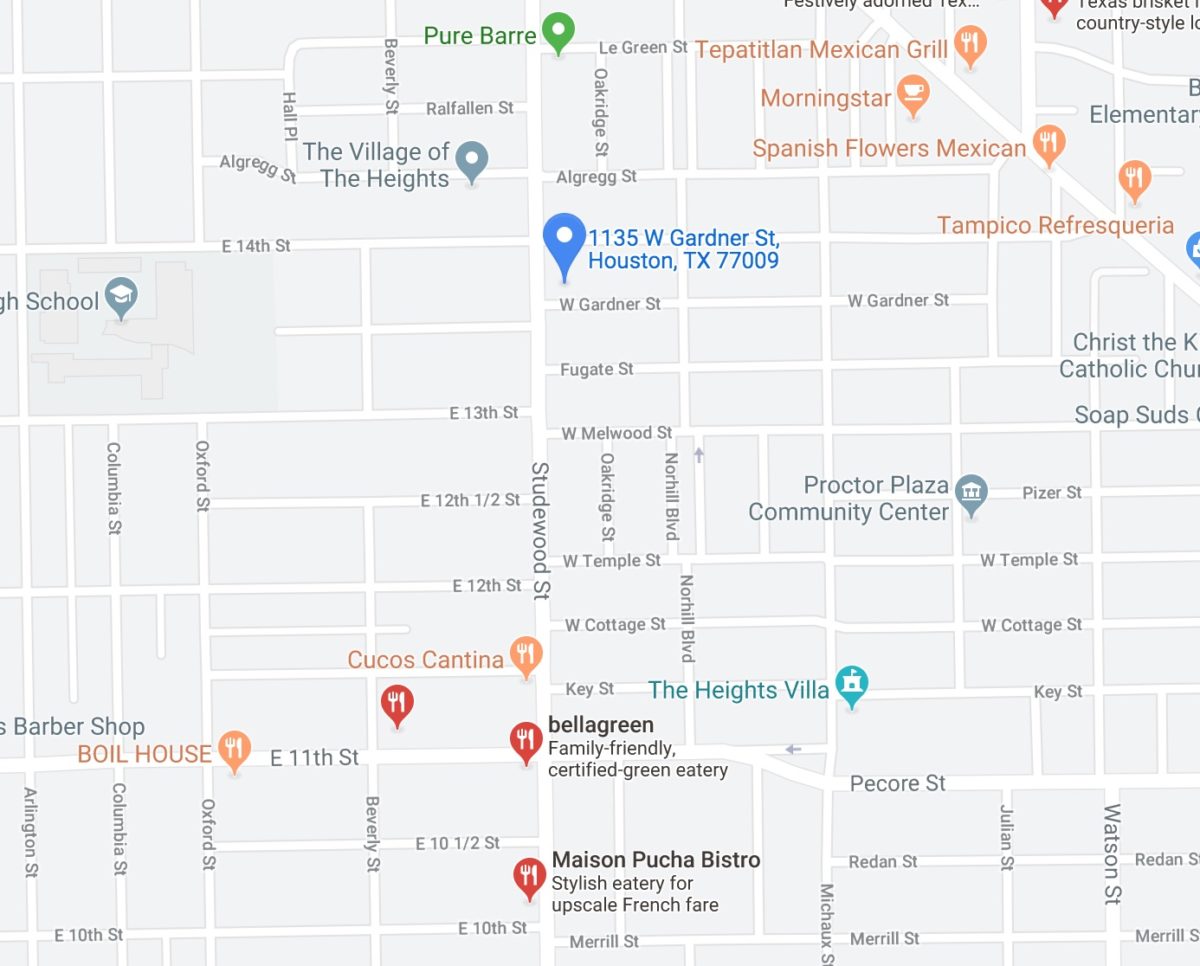

Welcome Home! This adorable cottage is located in the Historical District in the Houston Heights. The home is appointed with two spacious bedrooms with cedar lined closets. Large living room with amazing windows and lots of natural light. Formal dining room, and large kitchen with plenty of counter and storage space. Beautiful original hardwood floors. This home has a 2 car detached garage and sizable backyard; perfect for outdoor entertaining. Enjoy an evening on this amazing front porch. You will love all the details and charm.

This tree lined streets and the beautiful mature trees makes this a perfect location. It’s minutes from downtown Houston, The Galleria, Memorial Park and the Energy Corridor. Enjoy all the Heights has to offer with nearby shopping, amazing restaurants, and parks.

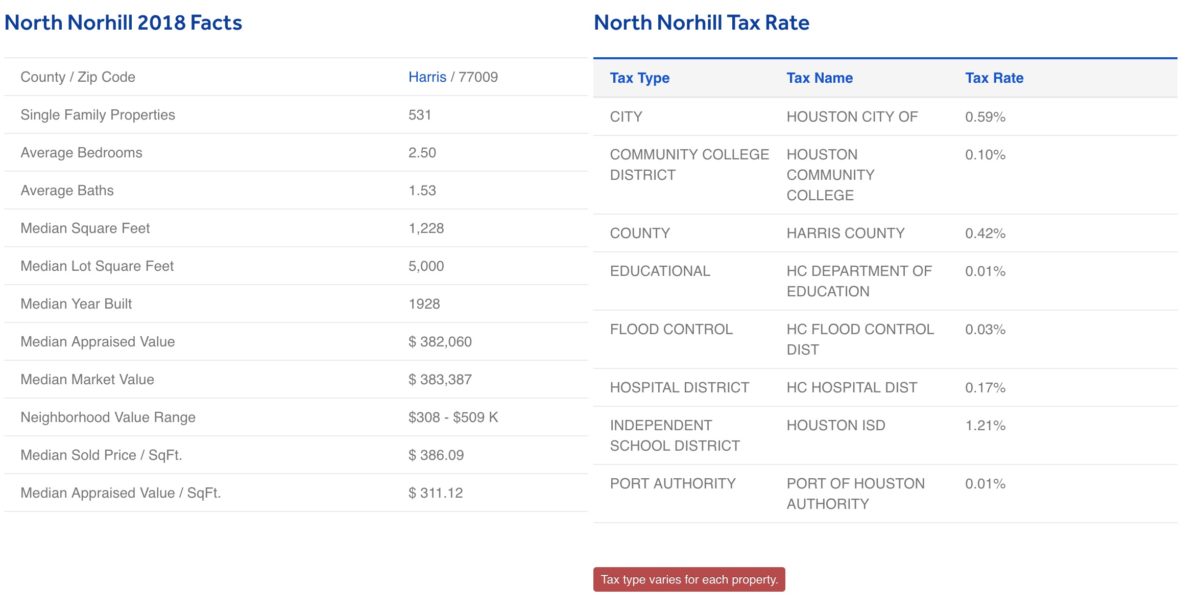

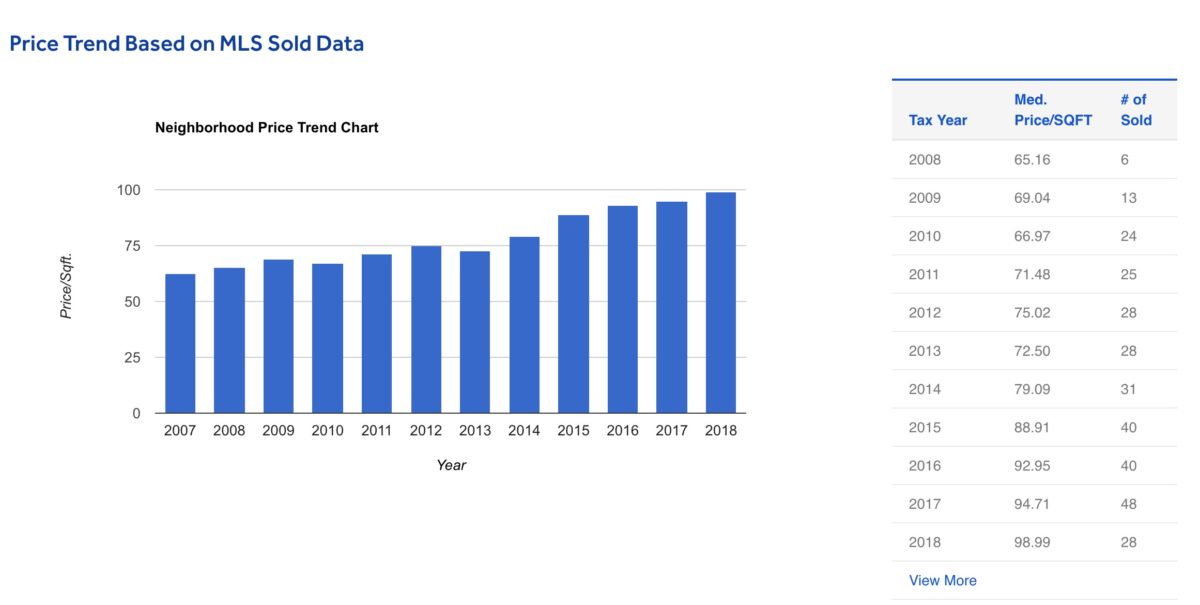

North Norhill neighborhood is located in houston (77009 zip code) in Harris county. North Norhill has 531 single family properties with a median build year of 1928 and a median size of 1,228 Sqft., these home values range between $308 – $509 K. The sqft. price change data is available through 1998. The median sold price/sqft is $386.09. Source: HAR.com