Speak to your Real Estate agent about possible changes/rules that you can implement to make your property tours safer.

These restrictions may reduce the number of visits but it will assure you that those that do tour your property are serious buyers.

1. Have your listing agent request a copy of the buyer’s pre-qualification in advance. If they are not pre-qualified they shouldn’t be touring your property.

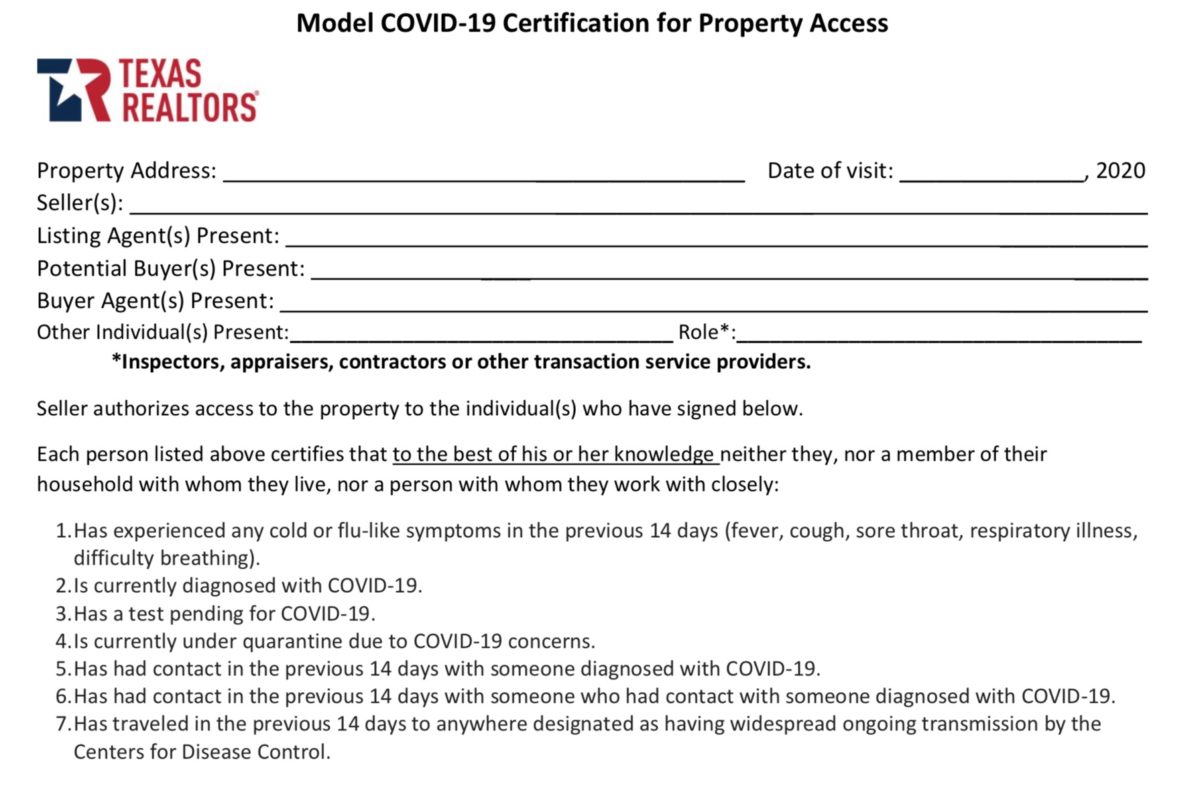

2. Have your agent use the following form to at least ask if the parties that will tour your property have symptoms.

3. Have all persons entering your home remove their shoes 👞👡 right outside your home. Add a note to your front door requesting this just in case the buyer’s agent forgets to tell their client.

4. Clean frequently touched surfaces and objects daily (e.g., tables, countertops, light switches, doorknobs, and cabinet handles).

5. Consider offering hand sanitizer by the front door. Add a note asking those entering to please use the sanitizer before they tour your home.

6. Speak to your agent about offering a video tour of your property. Sometimes a video with answer the questions buyers have about your property and they might rule it out based on further details. The truth is that your home is not for everyone. Let’s limit the tours to the ones that really are interested.

🗣This works both ways, if you as the seller are feeling ill please speak to your listing agent about canceling all showings until further notice.

We all have to do our part to help stop the spread!