Since you are selling your home by owner, you’re probably getting swamped by calls, letters, and even some knocks on your door.

But, does it seem like most of them are from real estate agents?

Unfortunately, that’s the way it goes for many people who try to sell on their own.

Also, most of the agents you hear from are trying to convince you…

- To list with them

- That you’re going to lose money

- That they can get you more money

- That they can sell it quickly

- Yada, yada, yada…

I’m not touching base to say any of that. In fact, I wish you the best of luck!

The reason I am reaching out is to see if you’re looking to buy a house.

If you are, I would love the chance to work with you on your purchase.

I understand trying to save money when you’re selling a house. I truly do. But on your purchase, the cost of a buyer’s agent is part of the price you’re paying for the house. So, you might as well work with an agent…and the best one you can find, at that.

So, I’d love to chat or meet and give you a feel for why I am the best one for the job.

Just give me a ring. I’m looking forward to hearing from you!

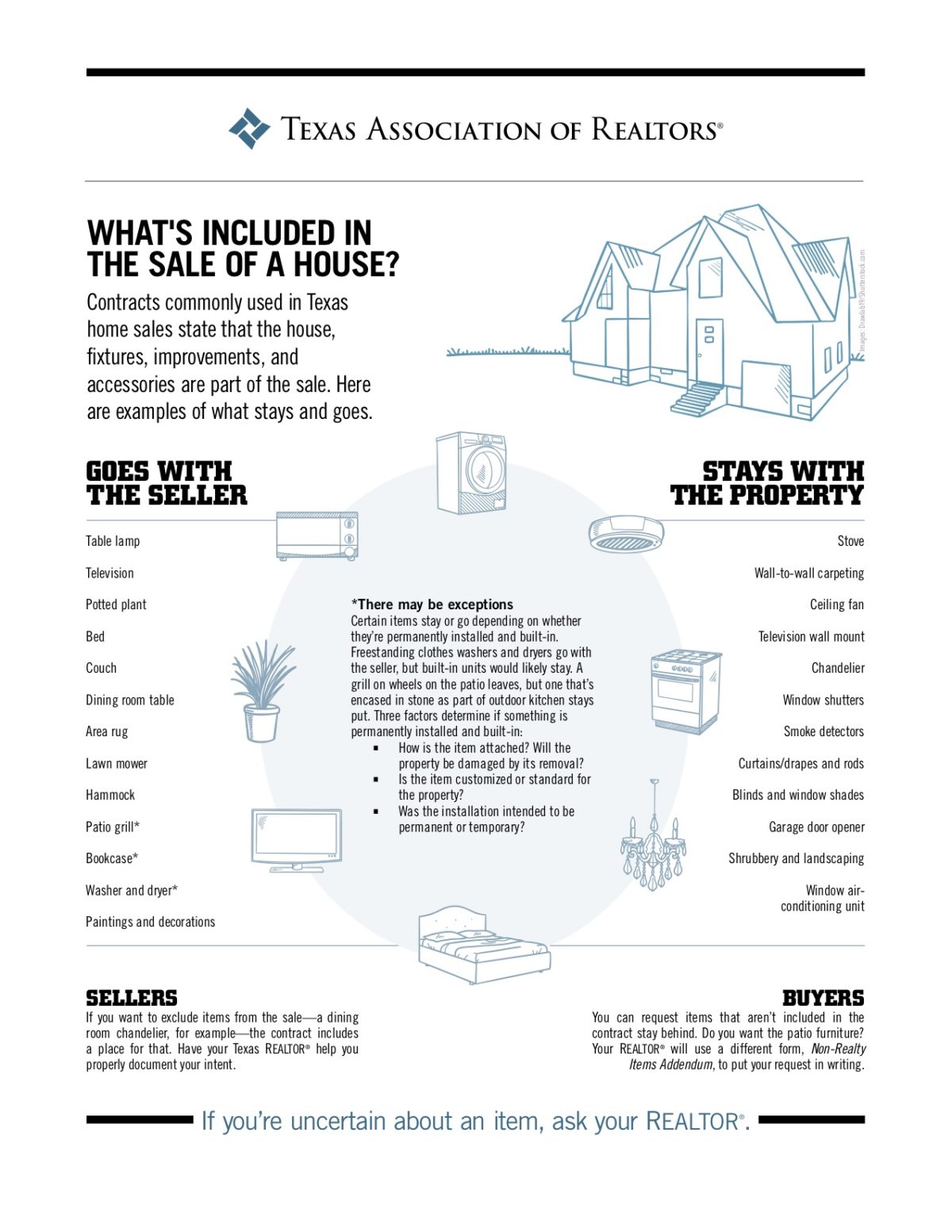

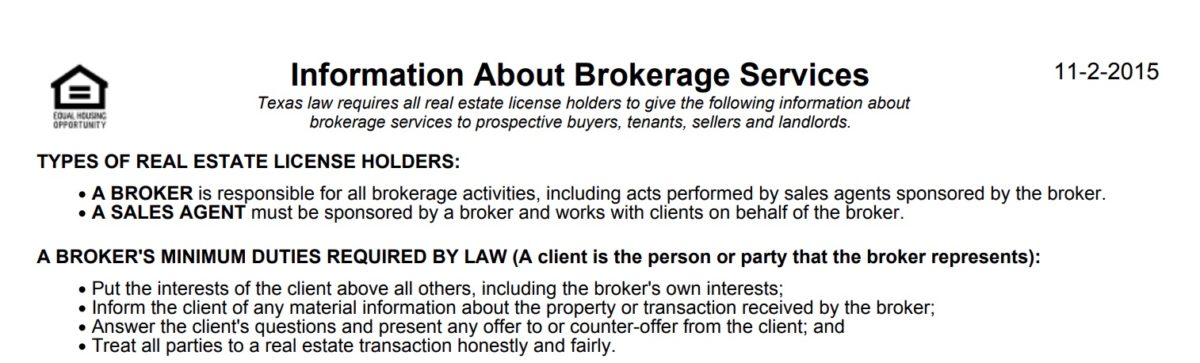

P.S.: Would you like a free estimated market analysis on your home and comps. Now, keep in mind, it is an estimate since I’ve never toured your home to get a true insight. This will be a little more insightful than a “Zestimate” however, those buggers can be pretty off the track sometime. I’ve also attached a disclosure form. You’re going to need one of these to keep you protected after a sale, to ensure the buyer doesn’t come back and try to say you hid anything.

You will also find a FSBO guide. I hope you find it helpful