Note: A qualified real estate attorney should be consulted to answer any questions as well as write the sales contract and promissory note.

What is owner finance?

Owner financing is also known as seller financing. This can be an option for people that can not qualify for a conventional bank loan.

In an owner finance agreement, the owner or seller will act like the bank. They will list the finance terms they are willing to offer. Owner financed deals are recorded with the County. The buyer’s interests is protected. An additional protection is that a trustee has the deed instead of the seller. The Deed of Trust in an owner financed deal will show that the buyer is the rightful owner.

Just like a traditional bank loan, there is usually a down payment, amortization period, a possibly balloon payment and a set or adjustable interest rate. The terms can be customized to fit the needs of the seller and buyer.

Most owner-financing deals are normally short term and a typical arrangement might involve amortizing the loan over 30 years but with a final balloon payment due after five. The idea is that after 5 years the buyer may be in a better financial position and can now get a traditional loan.

How does it work?

A contract is negotiated. The contract should include a Seller Finance Addendum that will disclose the terms of the agreement. It should cover the balance to be financed, the down payment, interest rate, balloon payments, pre-payment penalty, etc.

Part of the closing documents will include a promissory note. This is a very important document; it will include all the loan terms, the loan amount, the amount of your monthly installments, interest rate, payment schedule, late fee terms, balloon payment (if applicable) and when and how you need to pay.

Most promissory notes will have a due-on-sale clause that will make the entire balance due if the buyer decides to sell the property before the balance is paid off.

A deed of trust will also be signed and it’s usually recorded at the county’s clerks office. This legal document protects the seller in case the buyer defaults on the loan. It will allow the seller to foreclosure of the property if payments are not made.

Like any option, there are pros and cons. Let’s explore these below.

PROS

- Buyers that can not traditionally qualify through a bank might qualify through a seller directly. Banks sometimes have a very black and white way of looking at things. A seller might evaluate the buyer’s entire potential and make a decision based many other factors.

- The loan terms can be customized to fix the parties needs.

- Flexible down payments.

- The closing may be faster. With a traditional loan the closing can take 30-45 days.

- The closing costs could potentially be less. They might not include some of the normal lending fees

CONS

- The loans terms can be less desirable.

- The sales price and down payment requested could be higher.

- Interest rates can also be much higher than market rates.

- The amortization period might be too short or too long for comfort.

- The seller might include a balloon payment after 5-10 years.

- There usually is no appraisal involved so you might pay more that market value (Do your research).

- There might be pre-payment penalties

- The interest rates might not be fixed.

Ultimately owner financing can be a good option for both buyers and sellers but there are risks.

Buyers be warned

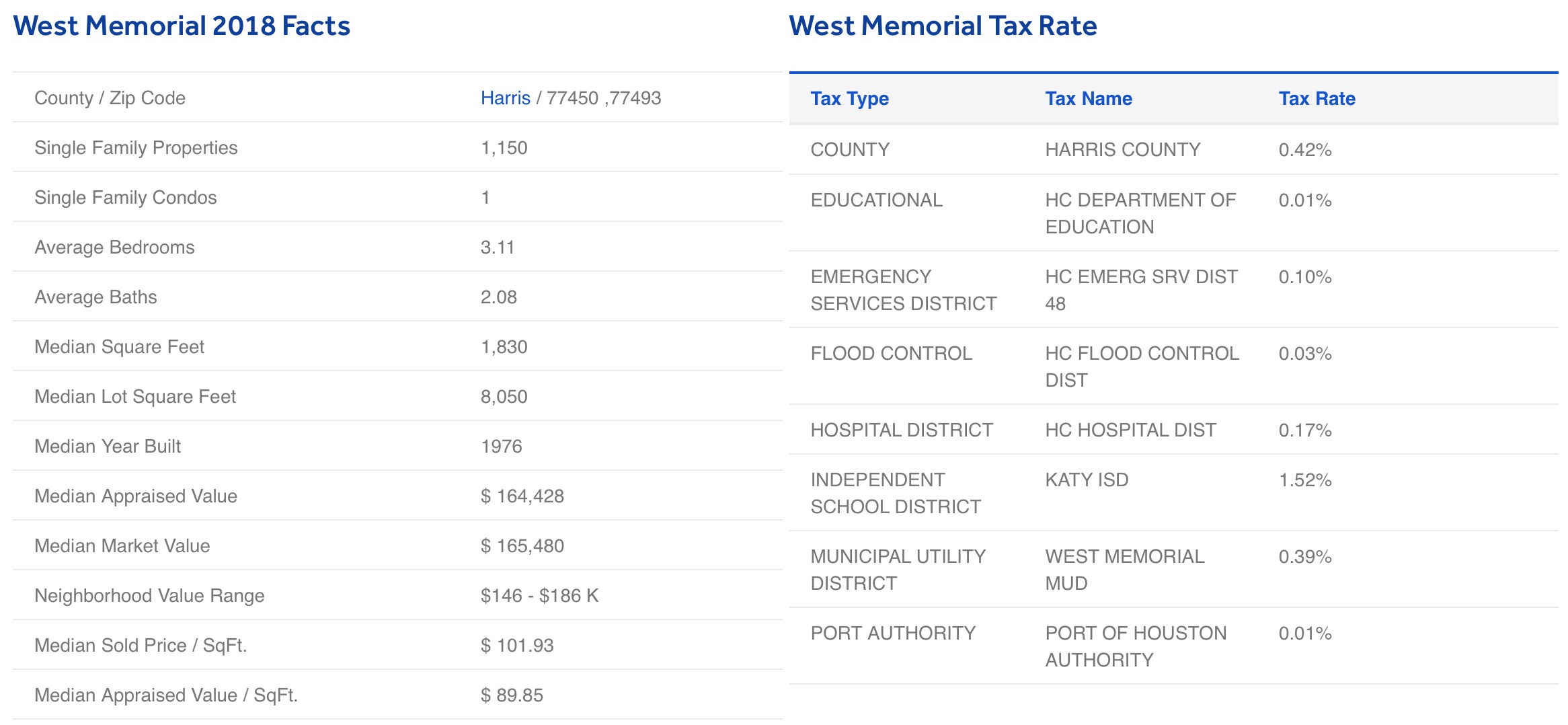

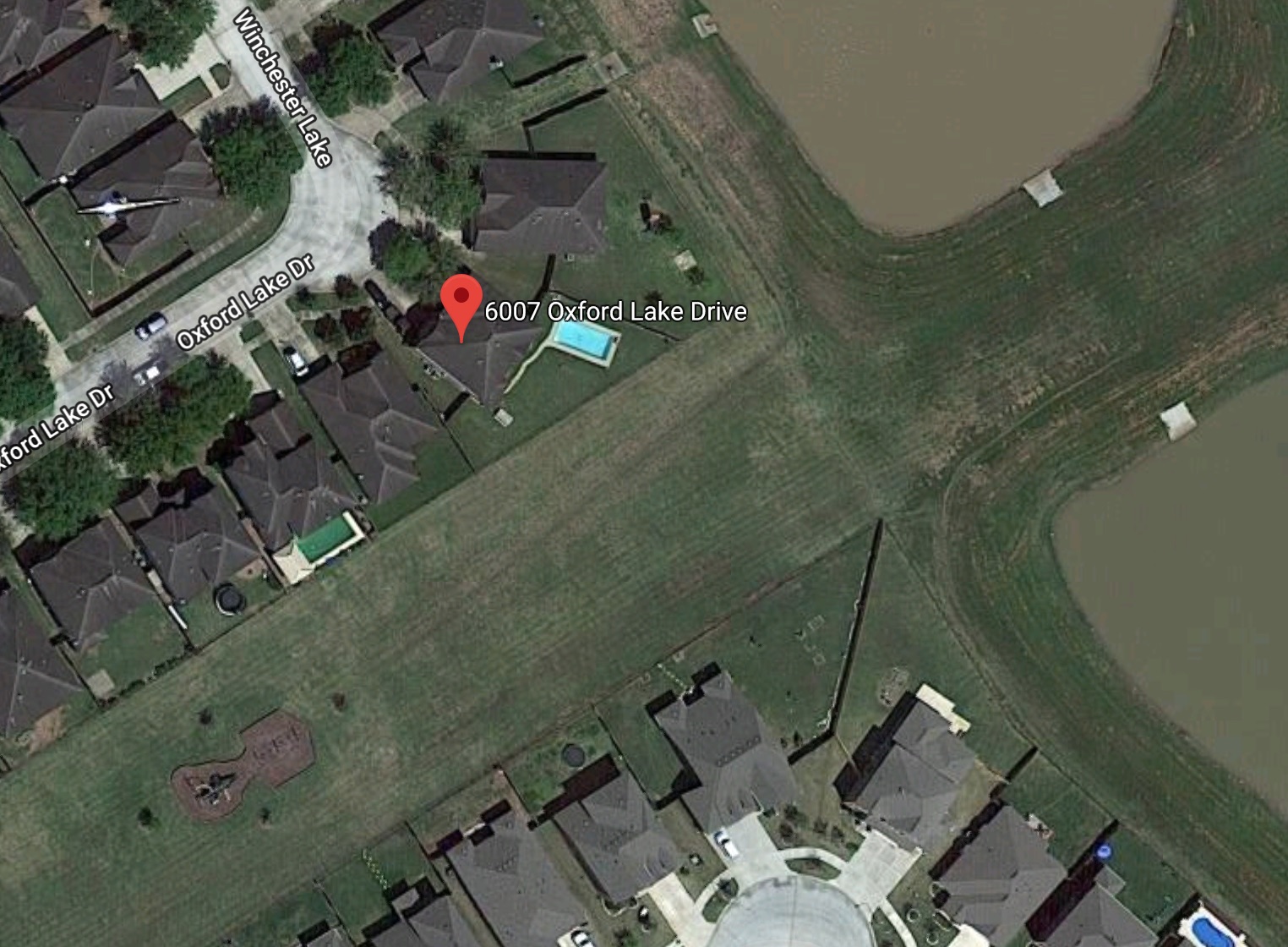

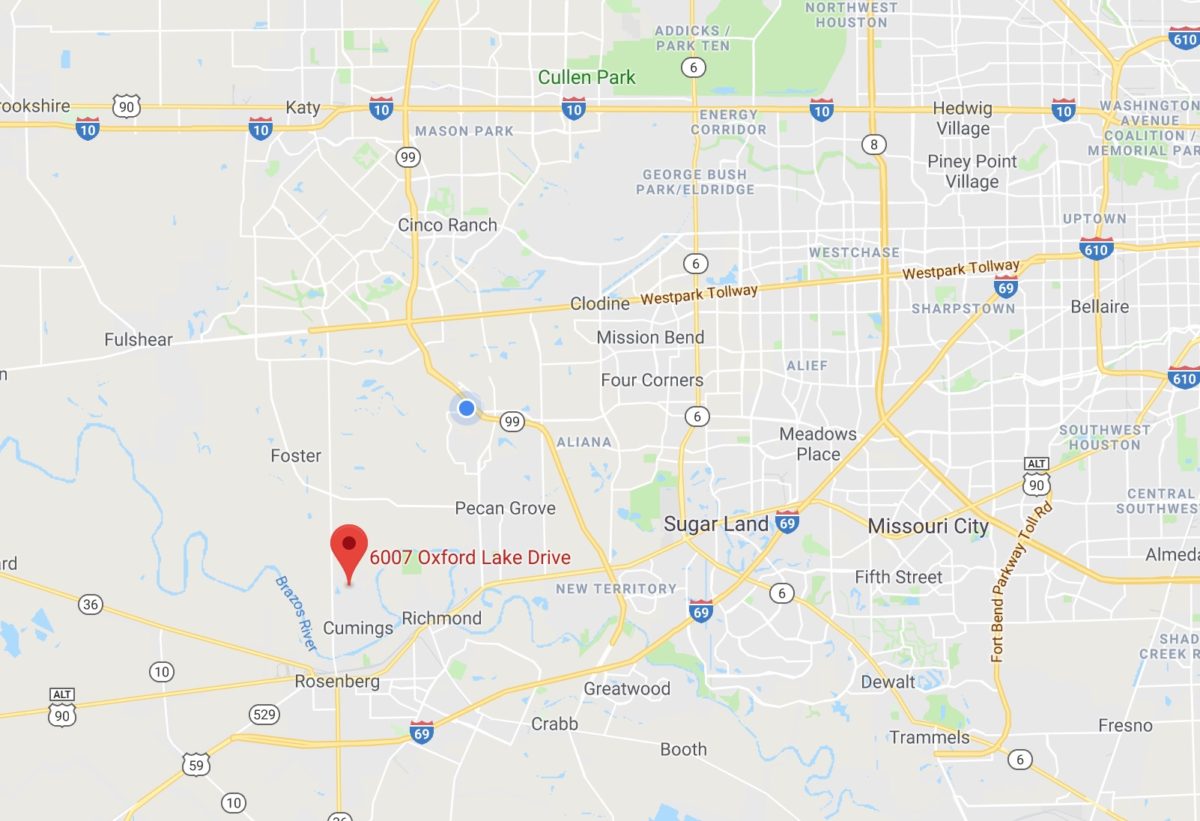

As a buyer thinking about owner financing, do your due diligence. Research the property, the community, the seller, etc.

- Beware of homes that are exclusively being offered as owner finance. Why? Are they selling the home for much more that market value? Is the home in poor condition? Are they trying to avoid home inspections or appraisals? Ask the questions.

- Did the seller ask your for a credit report, financial statements, proof of income, etc? If the seller is not looking into your finances, walk away. They should care if you can afford the home. Ideally you want your monthly payment to be less than 30% of your monthly income.

- Is the home paid off? If the seller owes a balance on the home, there is a higher risk for the buyer. You may be punctual in your payments but what happens if the seller doesn’t apply your payment to his mortgage? His mortgage company can foreclose of the home. You can end up losing all the funds you have paid towards the home plus the home itself!

- If the seller still owes a balance make sure that their mortgage does not have a due on sale clause. If they do have a due on sale clause, the bank can his bank demand immediate payment of the debt in full if the house is sold to you. If the lender isn’t paid, the bank can foreclose. To avoid this risk, make sure the seller owns the house free and clear or that the seller’s lender agrees to owner financing.

- Balloon payments – with many owner financing arrangements, a large balloon payment becomes due after a set number of years. If you can’t secure financing by then, you could lose all the money you’ve paid so far, plus the house.

- Consider having the home inspected. A home inspection is always an option for a buyer. These inspections are typically completed by a third party inspection company and will typically cost $350-550. If the seller does not allow you to have the home inspected, let this be a warning sign. What is he/she hiding?

- The seller should provide you with seller’s disclosures. All seller should disclosure issues that they know to be wrong with the property.

- Since a bank is not involved, there might not be an appraiser. In a traditional bank loan process, the bank will send an appraiser to evaluate the property’s worth. The appraiser will issue his opinion on value and condition. An appraiser is not an inspector, but if they see something that might effect the property’s value, they will note it and possibly force the parties to make repairs before the bank approves the loan. You as a buyer can order an appraisal of the property. If you are not sure of the market value of the property, speak to an REALTOR® or hire an appraiser.

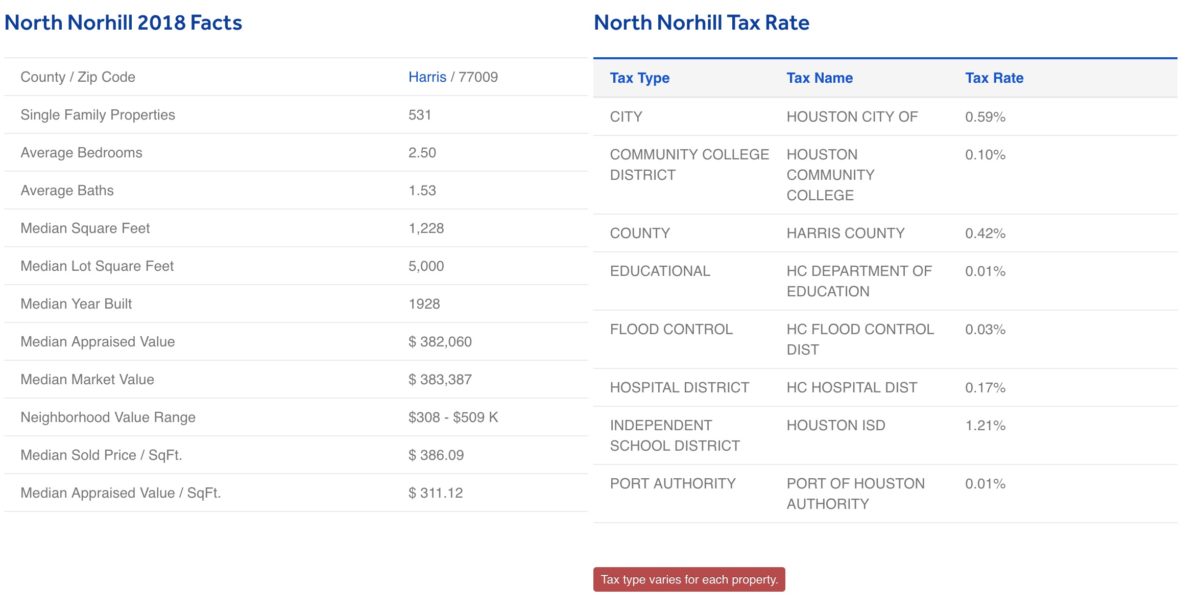

- Research the community and schools. Even if you don’t have school aged kids, schools can make or break a property’s resale worth. Properties zoned to poor preforming schools might not resale as well as those zoned to excellent schools.

- Traditional owner-financed transactions often close in a lawyer’s office without title insurance, although it might be wise for the buyer in such transactions to at least obtain a title report indicating what liens, lawsuits, and judgments may affect the property. There has been fraud in this area. People that are not the true owners of a property might try to sell or rent a home they know to be vacant.

- This is one of the largest purchases you will probably make. You might want to consider hiring a real estate attorney to review the terms of the contract prior to signing an agreement.

- The owner will normally keep title to the house until the buyer pays off the loan. If the buyer defaults, the seller keeps the down payment, any money that was paid, plus the house.

Sellers be warned

As a seller you too run risks when owner financing a home. Do your due diligence before signing a agreement.

- SAFE Act – Sellers who engage in more than five (5) owner-finance transactions in a 12 month period must now have a Residential Mortgage Loan Originator License according to the Secure and Fair Enforcement for Mortgage Licensing Act, also known as the SAFE Act.

- If you owe a mortgage on the property, speak to your lender to see if you have a due on sale clause. If you do, then owner finance may not be possible. Once you sell the home your mortgage balance will come due entirely. Speak to your lender and see if they will agree to owner financing.

- Make sure to review the buyer’s income. Their financial strengths, their credit or lack of credit, their available funds, etc. Speak to the buyer’s employer if they are not self employed. If they are self employed, considering looking at a few years of tax returns. You will decide what you find acceptable or not.

- Think about hiring a servicing company to receive the payments and establish an escrow account. This way the payment can be applied to the balance owed directly.

- The seller must determine that the buyer has the ability to repay the loan (and this must be supported by verifications and documentation).

- Although you won’t have to worry about insuring the property or making repairs as needed, you do run the risk of having to foreclose if the buyer stops making payments.

- Repair cost – if you do take back the property for whatever reason, you might end up having to pay for repairs and maintenance, depending on how well the buyer took care of the property.