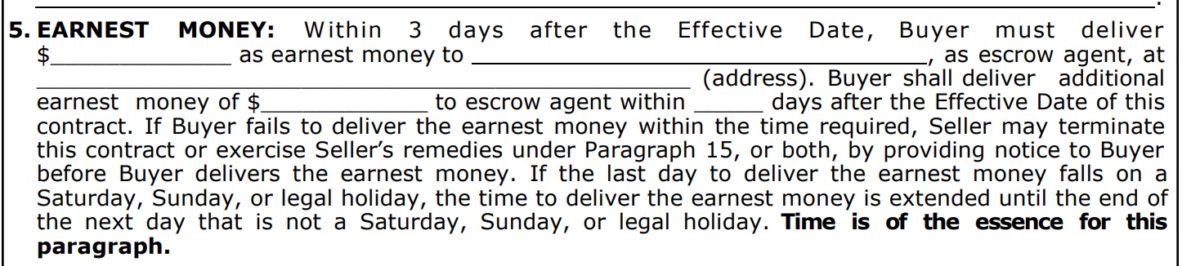

Earnest funds are one of a few funds you will need before you close on your home. It can be found in section 5 of the sales contact.

Earnest money is a deposit made to a seller showing the buyer’s good faith in a transaction. Typically it’s equal to 1% of the sales price. These have to be deposited with the title company within 3 days or less of an executed contract. These funds are held by a title company in an escrow account.

Once a buyer and a seller enter into a contract. The buyer may or may not be able to reclaim his or her earnest money, depending on how the contract is phrased. Contracts will typically have contingencies written in to protects the buyer and allows them an out if the home’s inspection is unacceptable or if the home does not appraise for the agreed upon sales price.

The contract does not protect the sellers from these unknowns but they take the home off the market while the home gets inspected and appraised. To prove that the buyer is serious, they will offer earnest funds, in good faith for the time the home is off the market. If the seller terminates the deal, the earnest money will be returned to the buyer.

These funds are not in addition to your sales price; The buyer receives a credit for these funds at closing.

- Never give an earnest money deposit directly to the seller. The check should never be made out to the seller. It should be made out to the title company.

- Get a receipt.

- Don’t pay the earnest funds in cash. These need to be paid by personal check or cashier’s check

There are ways that you can lose your earnest money deposit.

- Default of contract. Are you trying to cancel the contract outside your options? This might be default and could cost you the earnest funds

- You waived your contingencies – If the buyer waives their contingencies, they will lose their earnest funds if they should cancel or not be able to obtain financing.

- The buyer does not meet the deadlines specified within the contract and the seller and buyer can’t reach an agreement for the contract expires. Extension must be made in writing and signed off by both the seller and the buyer

- The buyer gets cold feet and he/she cancels the contract outside of their option period.

- The buyer wasn’t able to get financing due to reasons that could have been avoided:

- An increase in buyer’s debt (purchase a new car, purchased furniture, made any large purchase before closing)

- Quits his/her job

- Make a mystery deposit into their account and won’t explain why

- Co-signs a loan

- Opens new credit cards

- Spend the funds earmarked for your down payment and closing costs

When in doubt speak to you lender!

Upon cancellation, the sellers and buyers are asked to sign mutual earnest funds release form. If an agreement cannot be reached, the party holding the earnest money deposit will continue to hold it until an agreement is reached.

Remember before you sign a contract, chat with your agent and make sure that you cover all your options.