Don’t do any home improvements. Don’t renovate. Don’t spend one cent on improving your home before you list your house for sale…

…at least not until you speak with me.

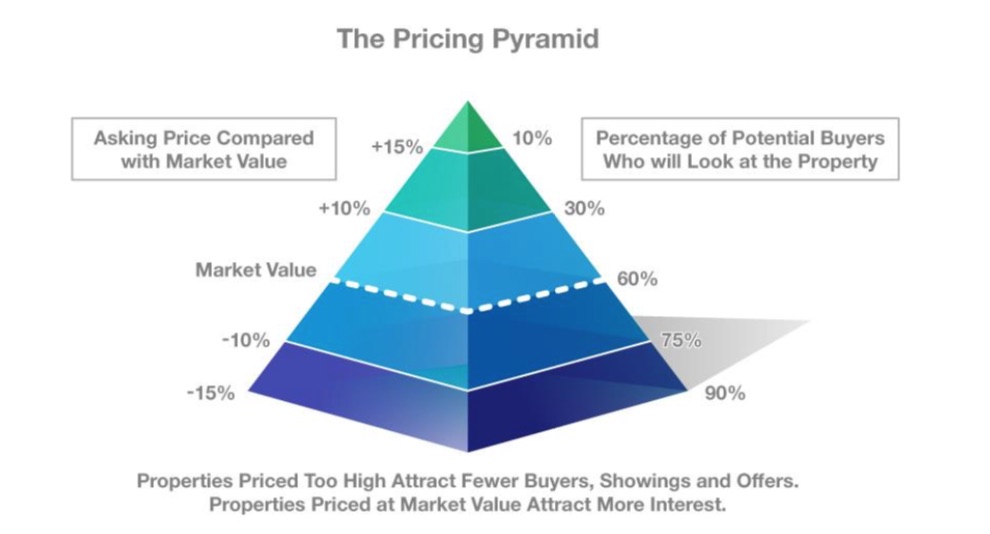

Too often, homeowners feel compelled to spruce up their home before putting it on the market. At face value, that makes sense. You want it to show as nicely as possible. And, it seems to make sense that if you improve the home, it will also improve the value.

However, many of the things homeowners spend money on do not raise the value as much as the cost of the project they completed.

The way I see it, my job is to make sure my clients net as much money as possible on the sale of their home.

And while that certainly entails getting a buyer to pay as much as we can for it, my job begins well before that…

Netting as much as possible is as much about not losing or wasting money, as it is getting as much money for your house as possible.

For instance, if someone spends even $1,000 on a renovation or improvement, and it doesn’t increase the value more than $1,000…it was probably a waste of time and money. Which means they didn’t net as much as possible.

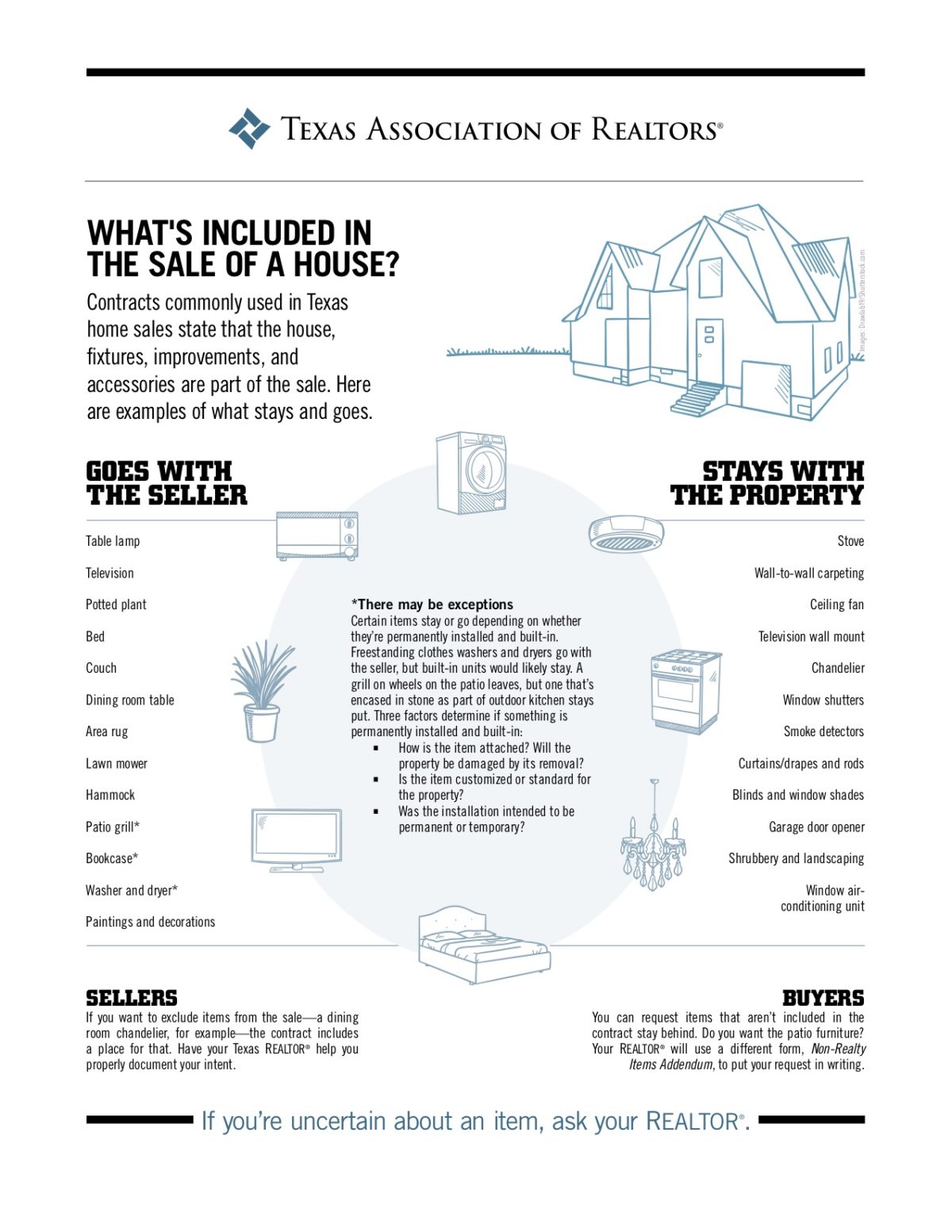

There are exceptions, of course. If something needs fixing, and it will get in the way of the home selling at all…well, then it will make sense to spend the money even if it doesn’t actually raise the value.

There’s no one answer. Every home and situation is different. It takes analysis and thought before I can say whether it’s worth doing something or not.

So I recommend, and offer, to come by and assess whatever project you may be considering, before you just go ahead and do it. (As always…no obligation, and completely free.) It’s my pleasure. And, the way I see it, it’s my duty.

Give me a call and we can schedule a time for me to swing by and take a look.